About EUR/USD

The US dollar is the most traded currency in the world, and the euro is the second. Not surprisingly, EUR/USD is the most traded currency pair in the world. The two currencies that form this trading pair represent two of the world’s largest economies and markets.

Euro

After decades of discussion and years of planning, the euro became a reality on the 1st of January 1999. The euro is a currency used by nineteen countries in the European Union.

US dollar

The US dollar came to existence in 1792, shortly after the American Revolutionary War ended. Following a series of significant geopolitical shifts, such as WWII, the USD became the world’s leading currency.

EUR/USD CFD Specifications

When you trade with EUR/USD, the base assets are in Euros and the quote assets are in Dollars. The contract size, often known as the lot size, amounts to 100,000 euros. The minimum order size to be placed is 1,000 euros, also referred to as a micro-lot or 0.01 lot. Orders can only be placed in steps of 1,000, i. e. the second smallest order size to be placed is 2,000.

EUR/USD is stated with five digits (after the decimal point). The fourth digit is known as pip, and the fifth digit is known as point. The value of a pip depends on the size of the contract. In case the contract size is 1 lot, the pip value would be 10 USD. In case the contract size is 0.01 lot, the pip value would be 0.10 USD.

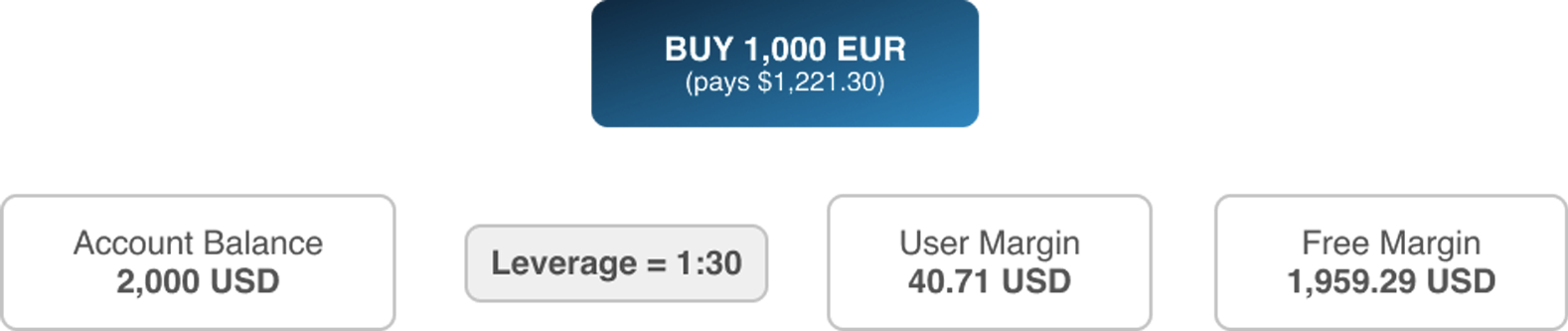

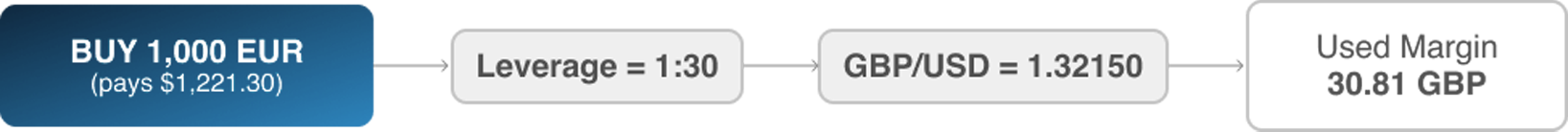

One of the advantages of CFD-trading is that you may trade with leveraging effects, thus requiring less money to open a trade. Trade Markets offers a leverage of 1:30 for trading with EUR/USD, i. e. you only need to provide a margin of 3.33%, to open a position.

The leveraging effect is an important tool for trading with Forex-CFDs, as small price movements have a greater impact on larger positions. However, do not forget that in case the price moves against your position, the larger the position, the greater your losses.

Why trade EUR/USD?

* Risk Warning: Trading in forex and CFDs could lead to a loss of your invested capital.

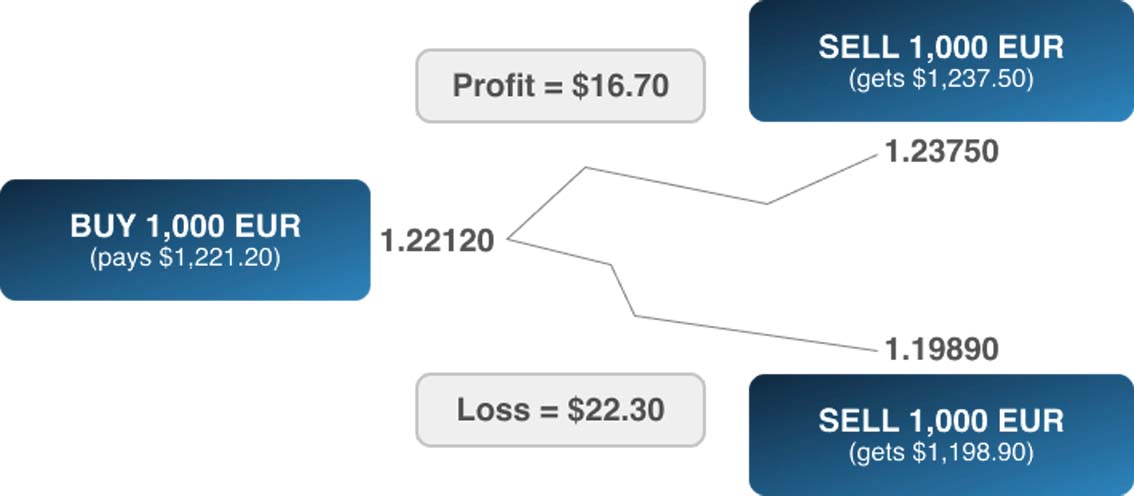

How a CFD transaction works

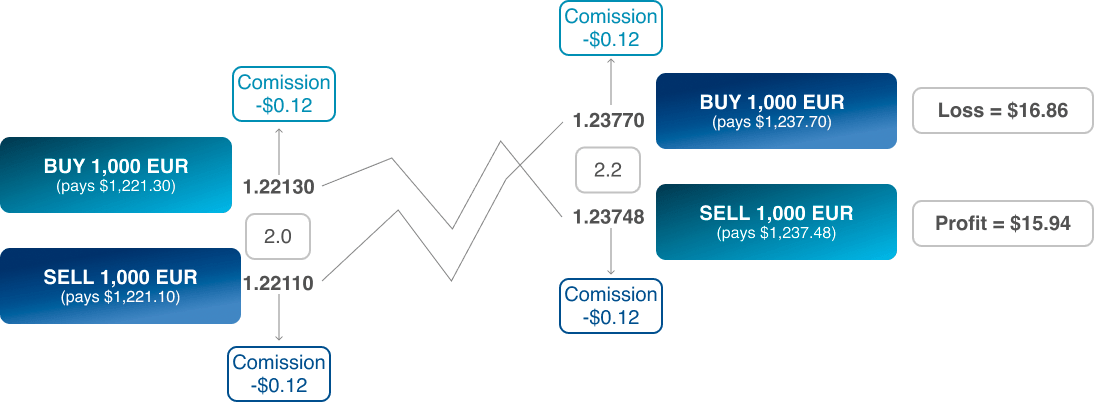

When you go long on EUR/USD, you’re theoretically buying euros with dollars. When you close the trade, your profit or loss will be calculated in dollars. If the euro strengthened against the dollar, you’d get more dollars when you close the transaction. If the euro weakened, you’ll get back fewer dollars.

With leverage, you’re able to open larger positions than your capital would otherwise permit. When you trade forex CFDs with Trade Markets, you can use leverage as high as 1:30; meaning you only need to provide margin to cover 3.33% of the position’s value.

When you trade forex CFDs, you don’t need to own either of the currencies included in the pair. For example, if your trading account balance is denominated in British pounds, you can still trade EUR/USD. The purpose of a CFD is to enable traders to speculate on the price of one currency against another. When a CFD is concluded, it will always be settled in cash, i.e. by increasing or decreasing the amount of balance in your trading account.

Costs to trade EUR/USD

There are different costs involved when trading CFDs with Trade Markets. There are three primary factors which influence how much you pay for your transactions; they are:

The size of your trade, the bigger the trade, the higher the fees.

The instrument you’re trading, as different products have different characteristics.

The type of account you have, as different accounts have different conditions.

Commissions are charged when you open and close a trade. In this example, the commission charged is €10 per Lot. Once adjusted according to the trade size of 0.01 Lots the commission becomes €0.10. When converted to dollars, it becomes $0.12.

A swap is a fee for holding positions overnight. The price is derived from the base and quote currency’s interest rate differential and varies depending on whether your position is long or short. In this example, the swap rate for a long EUR/USD position is 5 Pips, and the rate for a short position is 1 Pip.